Report: Rewilding Finance

Harnessing high-integrity investment to boost rewilding across Britain.

A radical shift in nature recovery funding and investment is needed to ensure the progression of large-scale nature restoration in Britain that’s vital to combat the nature and climate crises.

That’s why we’ve partnered with experts in nature positive financial mechanisms, Terranomics, to produce a new vision outlining how Britain’s funding landscape can be enhanced for scaling up rewilding. Just some of the findings of the Rewilding Finance Report, published in June 2024, show that:

- Major rewilding projects are struggling to navigate a confusing funding landscape

- Government funding schemes are under-delivering

- Rewilding projects and funders are frequently not finding each other

Practitioners are already tackling the interlinked nature and climate crises through large-scale landscape recovery. But the current system is holding them back.

We’re calling for:

1. Secure public funding and policy from UK and devolved governments

Recent developments in public payment for public goods schemes, nature market frameworks and funding mechanisms by the UK and devolved governments have been positive. But they have yet to provide the long-term certainty and stability that landowners, land managers, communities and investors need in order to commit to rewilding as part of a just land use transition. Clear and coordinated incentives are needed over at least 15 – 20 years, within well-enforced regulatory frameworks that support and safeguard investments and ensure that they bring shared value for nature, the economy and local communities.

Download the full Rewilding Finance report

Download pdf“Such an important report out, given the huge deficit in funding for nature restoration.”

Lorienne Whittle

Project Manager (Landscape Recovery), Boothby Wildland at Nattergal

2. Private and philanthropic sectors should accelerate large-scale rewilding

There’s increasing investor demand for Payments for Ecosystem Services, and Nature-Based Solutions as an investable asset class are quickly gaining traction. New mechanisms for financing rewilding are emerging at pace, such as ecotourism, and there’s also growing interest from investors in carbon and nature markets.

We need to pilot and fast-track a portfolio of high-quality, large-scale, investable rewilding projects that build confidence and demonstrate the holistic benefits that a rewilding approach can achieve for people, nature and local communities.

Download the summary version of the report

Download pdf3. Enable diverse locally- and community-led partnerships to upscale rewilding

Rewilding practitioners are a diverse group whose funding and financing needs vary significantly in scale and type. Achieving equitable and sustainable financial benefit sharing across these stakeholders can be challenging and their governance structures represent complex and unfamiliar ground for investors.

Building the capacity of trusted locally- and community-led partnerships or ‘anchor institutions’ to co-design large-scale investable rewilding initiatives will help to attract and coordinate significant inward investment. These should ensure that environmental, economic and social benefits are shared equitably and integrated within a wider green economic transition.

“This report is very timely, and does a great job of highlighting the key next steps needed.”

Alice McCourt

Biodiversity Net Gain Manager (secondment), Northumberland Wildlife Trust

4. Better connections between rewilding initiatives and investors /funders

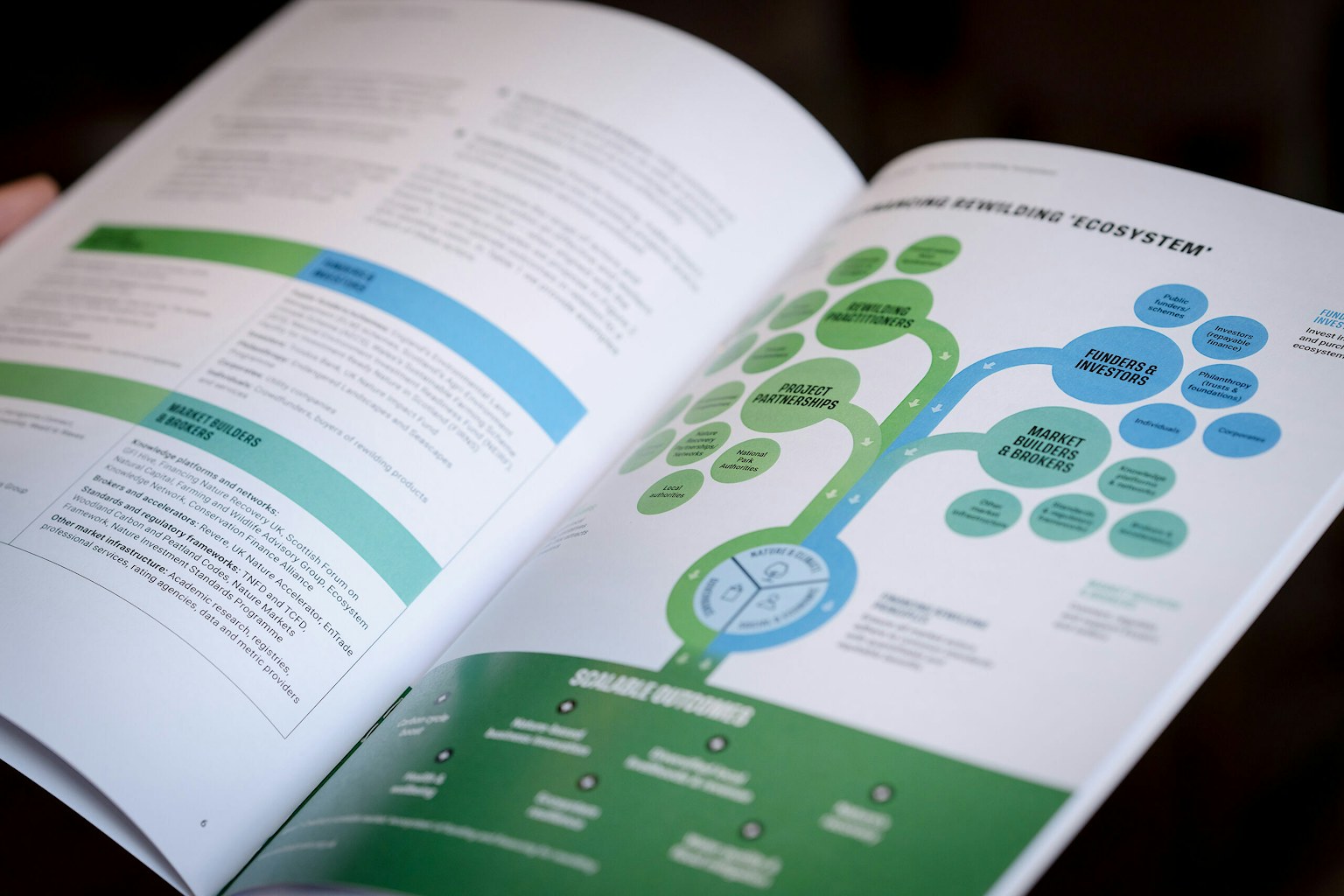

Enabling entrepreneurial networks of brokers and market builders could support the development of a market infrastructure that would more effectively facilitate multi-outcome rewilding projects.

Despite a plethora of networks, knowledge platforms, funding brokers, project accelerators, directories, registries and trading platforms the market infrastructure for nature restoration and rewilding funding remains fragmented. It lacks the standardisation and commonly recognised definitions and frameworks that investors typically need when assessing new opportunities, and doesn’t yet adequately support the specific characteristics of successful rewilding.

5. High-level, sustainable principles for investing in rewilding

We need to see rewilding practitioners, investors, governments, brokers and other stakeholders coalesce around common goals and navigate financing opportunities effectively. That’s why we’ve developed a set of principles for financing rewilding, which we believe will help ensure quantifiable and equitable environmental, economic and social benefits for — and with — local communities and wider society.

Financing Rewilding case studies

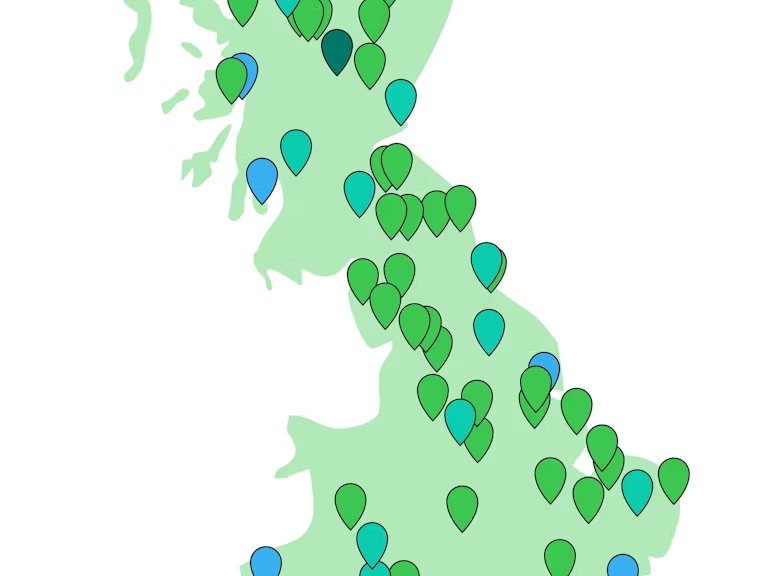

Explore how rewilding projects across Britain are using pioneering approaches to finance their work.

Finance Rewilding Case Studies

-

Case study: Nattergal

Nattergal is a private nature restoration company run by rewilding and financing experts. Its business model is to deliver ecosystem restoration and to commercialise the resulting ecosystem services generated.

-

Case study: The Atlantic Rainforest Restoration Programme

Insurance company Aviva is working to restore Britain’s lost temperate rainforests while helping it reach net zero in what is believed to be “the largest ever corporate donation into nature conservation in the UK.

-

Case study: Trees for Life

Based in the Scottish Highlands, charity Trees for Life has developed an innovative rewilding financing model on its land that provides direct community benefits through carbon credits.

-

Case study: Tarras Valley Nature Reserve

The residents of Langholm pulled off not one, but two, community buyouts to raise a total of £6 million to purchase a 4,249ha nature reserve from Buccleuch Estates — making the reserve south Scotland’s largest community buyout.

-

Case study: Revere

Revere is working to co-design and aggregate nature restoration projects across Britain’s 15 national parks into financeable portfolios for investors. Community benefits are a central requirement.

Rewild your business

Take action for nature and climate by becoming a corporate partner of Rewilding Britain.

Become a partner