Case study: Nattergal

Nattergal, a private nature restoration company run by rewilding and financing experts, aims “to make nature an investable asset class”. Its business model is to deliver ecosystem restoration on its own land and that of others, and to commercialise the resulting ecosystem services generated.

In summary

- Project type: Privately owned nature recovery company

- Location: Lincolnshire, Norfolk and Essex

- Current income: Investor equity, Landscape Recovery Scheme pilot, ecotourism, property rentals

- Projected income: Biodiversity credits, carbon credits, water credits, Landscape Recovery Scheme, direct investments, ecotourism, property rentals

Just over two years after its launch, natural capital company Nattergal has recently added a third low-grade agricultural site — Harold’s Park Wildland — to its portfolio of rewilding projects, where it’s busy working to recover biodiversity and natural processes. It has already purchased High Fen Wildland, a former sheep farm in Norfolk, and Boothby Wildland in Lincolnshire, a former arable farm.

Boothby is one of the 21 Landscape Recovery Scheme (LRS) Phase 1 pilots funded through the Environmental Land Management scheme. It’s this government backing that will support Nattergal with a base level of income until the natural capital markets and other income sources really take off, explains Ben Hart, Head of Operations. He added that it will “help us to develop faster and de-risk the business model so that eventually our other income streams like natural capital and ecotourism bring in the bulk of revenue.”

Explore our Rewilding Financing Report

Uncover our blueprint for a game-changing shift in funding and investment for rewilding.

Under the LRS pilot, a government grant of around £275,000 has enabled Nattergal to do baseline monitoring work at the site over a year and a half to understand the impact of different interventions on the land. Armed with this data, the company can now present a land management and blended finance plan to Defra and Natural England, to access a second LRS long-term funding package. This is likely to be some combination of an upfront capital grant, a long-term yearly payment plan, or an option for the government to purchase a certain percentage of natural capital credits generated onsite over a certain period.

Of those natural capital credits, Nattergal already has Biodiversity Net Gain units for sale, under the requirement that came into law in February 2024 for developers to create a net 10% increase in biodiversity, either onsite or offsite through habitat banks like Nattergal’s. “As developers get to grips with the new responsibilities, we are developing an exciting pipeline of opportunities,” says Hart.

Nattergal is also investigating the sale of voluntary credits for biodiversity, carbon and water. The challenge, Hart says, is that “many corporates still look at things through a carbon lens and are understandably unsure how to create a nature positive company.”

Yet there’s uncertainty around the suitability of credit trading schemes to rewilding. Rewilding interventions, which aim to create a mosaic of highly biodiverse scrubby habitats with a variety of benefits, don’t currently generate as many carbon credits under the Woodland Carbon Code or the Wilder Carbon Code as tree planting projects, for example. Nattergal is helping to fund and contributing to research that shows rewilding systems sequester much more carbon than previously thought. “There are multiple different carbon codes being developed,” explains Hart. “There is the potential for a rewilding carbon code to come out of this.”

Nattergal also aims to generate revenue through other nature-based enterprises that provide jobs and opportunities to the local community. A small part of Boothby Wildland will offer camping and glamping, and the company is considering hosting corporate events at their sites.

In an ideal world, Hart says that natural capital, and potentially direct corporate sponsorship, would account for around two-thirds of Nattergal’s income. Up to one-fifth would come from ecotourism and the remainder from other sources, such as organic meat sales and property rentals.

What will help get them there, he believes, is well-developed case studies on successfully funded rewilding projects. “As we get those out in the market, I think we’ll start to see a real step change from corporate buyers and financial investors.”

Long-term, Hart would love to see voluntary nature disclosure frameworks become mandatory for the biggest UK companies, just as the climate-related financial disclosures are. “That would trigger a wave of funding and truly support nature restoration at the scale we need to see.”

Published as part of our Rewilding Finance report, June 2024.

The Rewilding Network

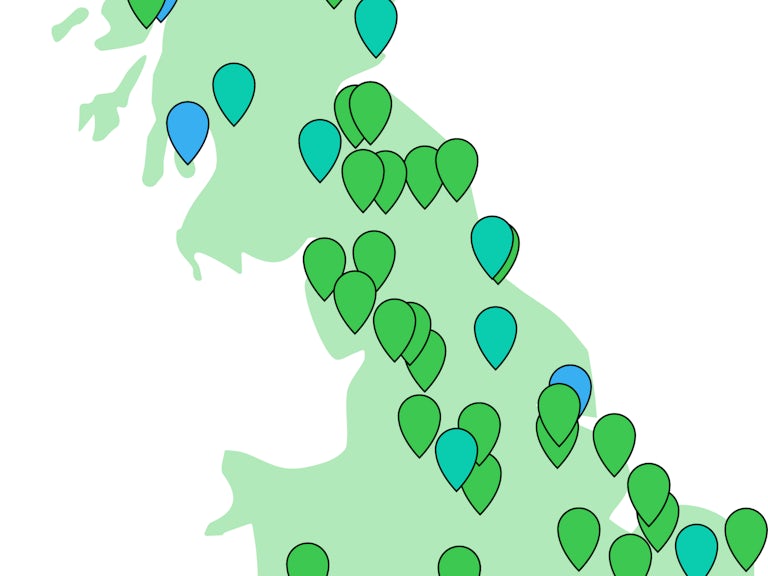

Boothy Wildland, Nattergal’s first site, is part of our Rewilding Network, the go-to place for projects across Britain to connect, share and make rewilding happen on land and sea.

Find out more about Nattergal and its rewilding sites

Join the Rewilding Network

Be at the forefront of the rewilding movement. Learn, grow, connect.

Join the Rewilding Network